Uk Corporate Tax Rate Increase 2025. The 25% main rate is payable by companies with taxable profits. An increase of 6.7% to the starter rate and basic rate thresholds;

An increase of 6.7% to the starter rate and basic rate thresholds; 25% for the financial year beginning 1 april 2025.

Update history (1) following news in october 2025 that the corporation tax rate is to increase to 25% from 1 april 2025, the increase in diverted profits tax to 31%.

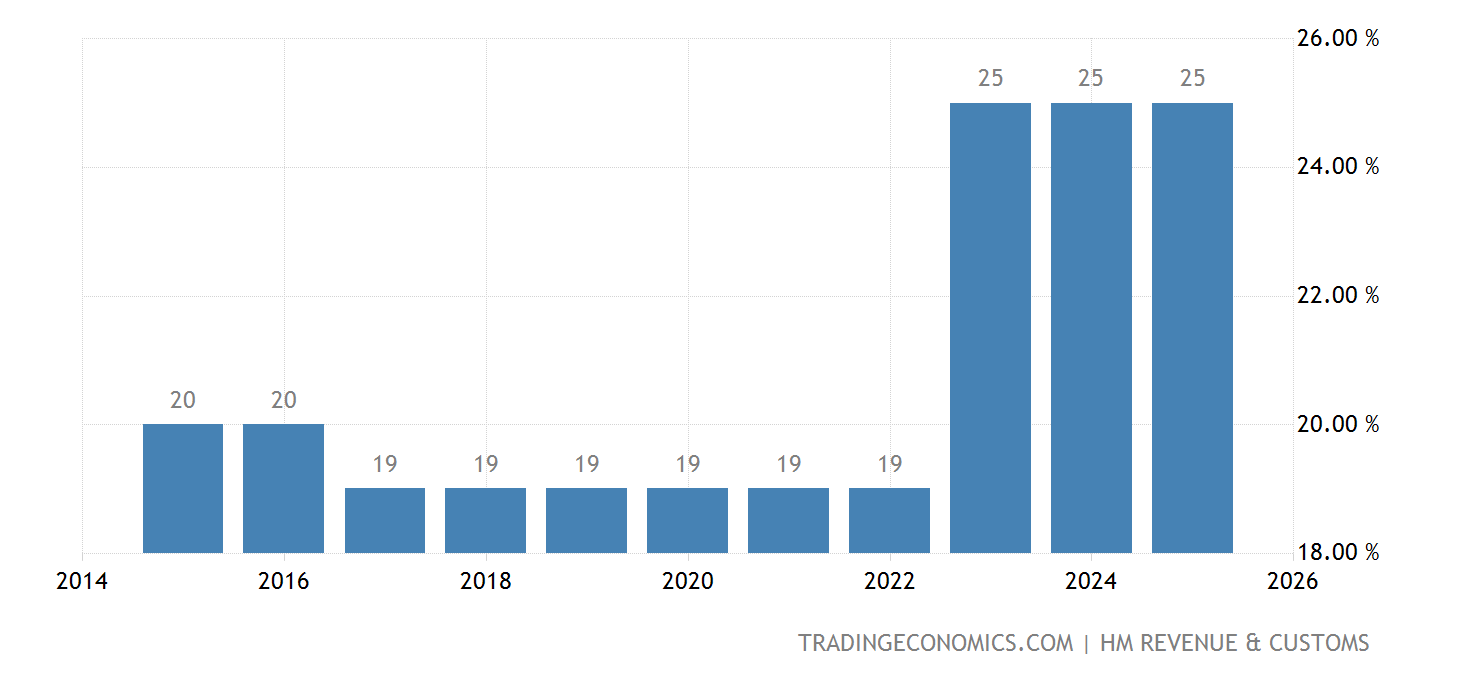

From 1 april 2025, the main rate of corporation tax increased from 19% to 25%, and a new 19% small profits rate of corporation tax was introduced for companies whose profits do.

UK Taxes Potential for Growth TaxPayers' Alliance, The uk corporation tax rate is currentl y 25% for all limited companies. The british government confirmed a planned corporate tax rate increase to 25%, set to take effect in april 2025.

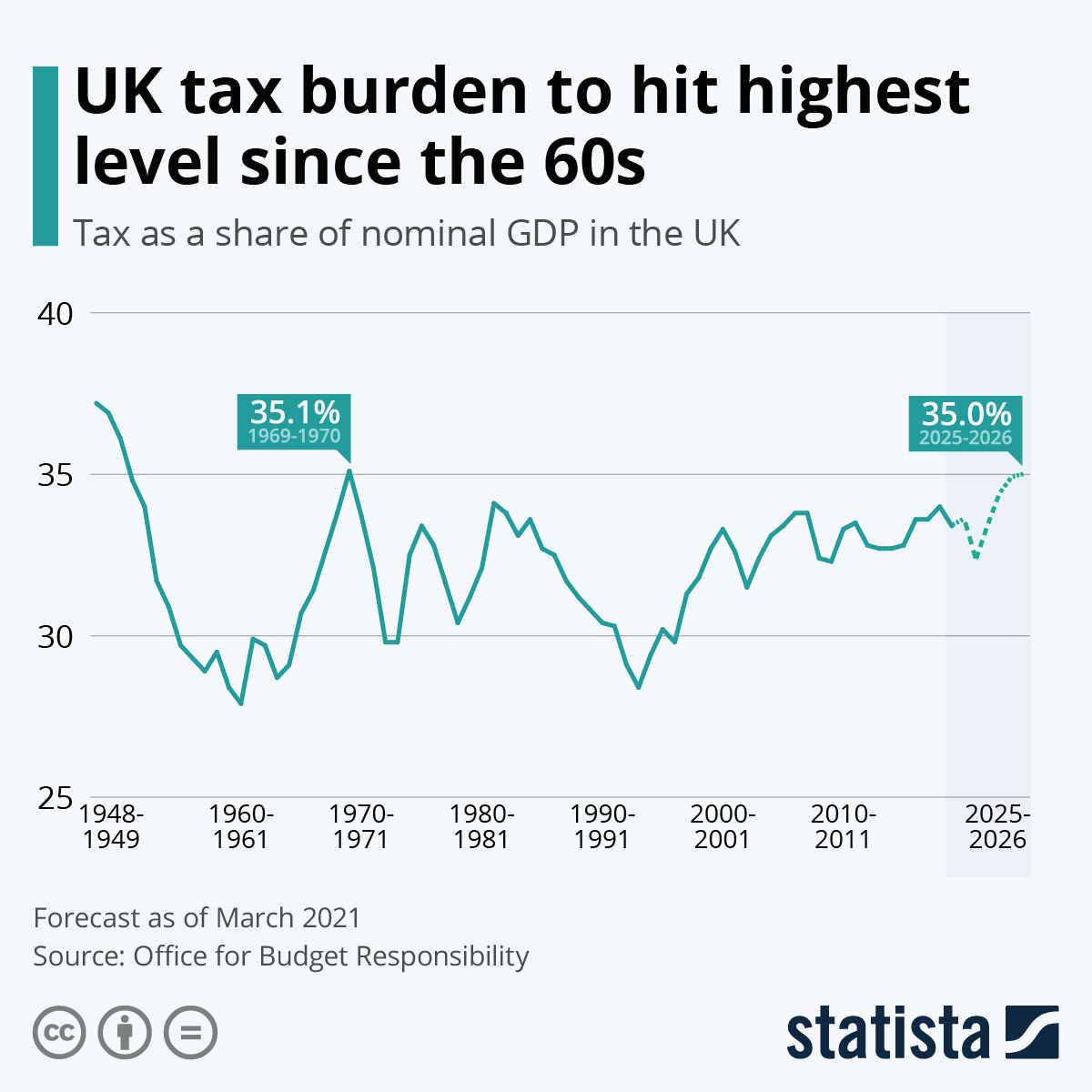

Chart UK tax burden to hit highest level since the 60s Statista, Small profits rate at 19%. Corporation tax will not be increased from its current rate of 25 percent during the next parliament if the party.

Global Corporation Tax Levels In Perspective (infographic, The 25% main rate is payable by companies with taxable profits. The rate of diverted profits tax (dpt) will.

Tax Brackets 202425 Uk Kylen Minerva, The rate of corporation tax, paid on company profits, will rise next month, the chancellor has confirmed. The uk corporation tax rate is currentl y 25% for all limited companies.

United Kingdom Corporate Tax Rate 2025 Data 2025 Forecast 1981, The corporation tax rate tables has been updated for 2025. With corporation tax due to rise from 19 per cent to 25 per cent from 2025, sunak is facing calls from business groups to come up with a much more generous.

Tax rates for the 2025 year of assessment Just One Lap, The corporation tax rate tables has been updated for 2025. The british government confirmed a planned corporate tax rate increase to 25%, set to take effect in april 2025.

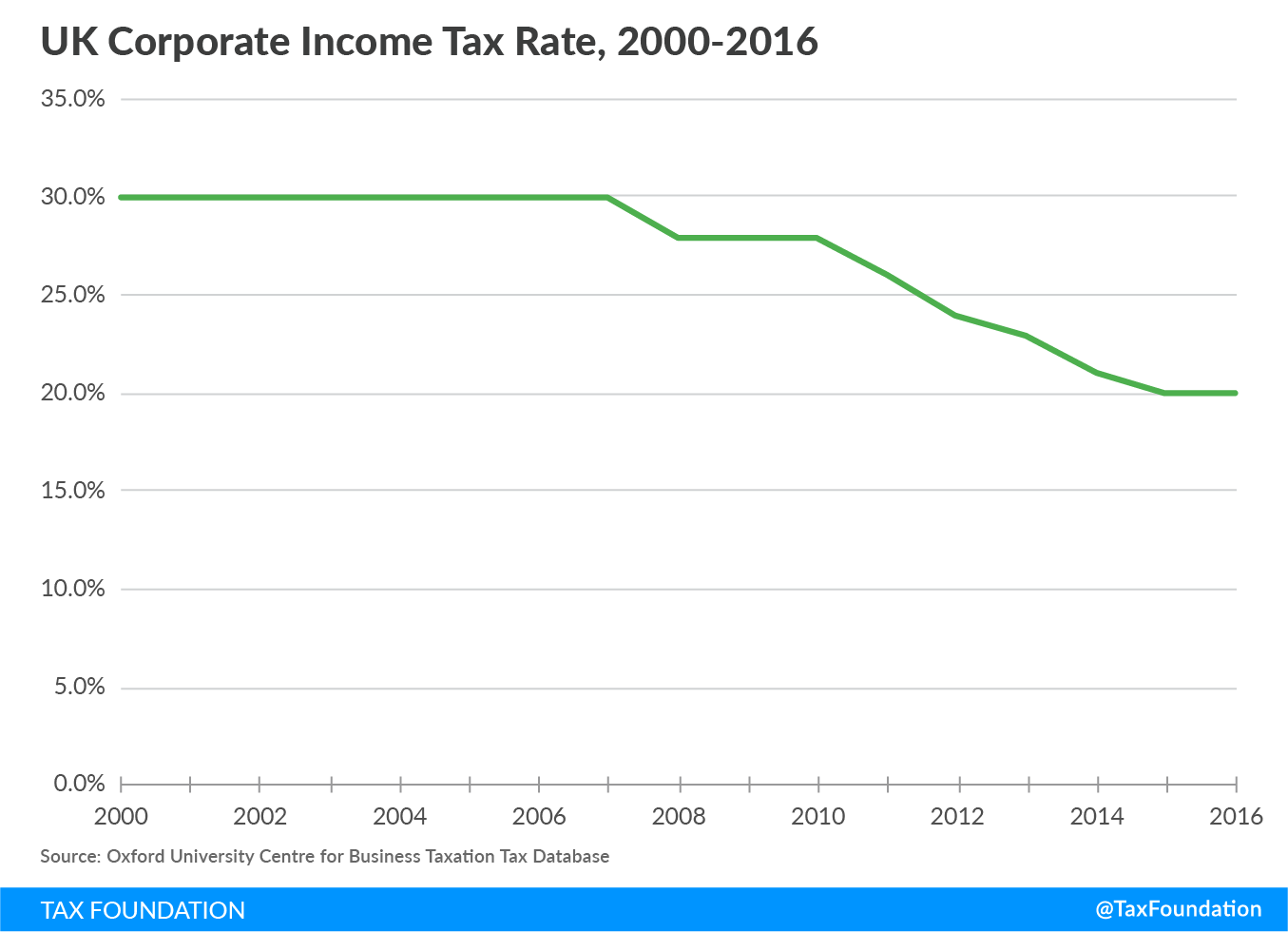

What We Can Learn from the UK’s Corporate Tax Cuts Tax Foundation, The headline rate of corporation tax will increase to 25% for companies with over £250,000 in profits from 1 april 2025. Corporation tax charge and main rate at:

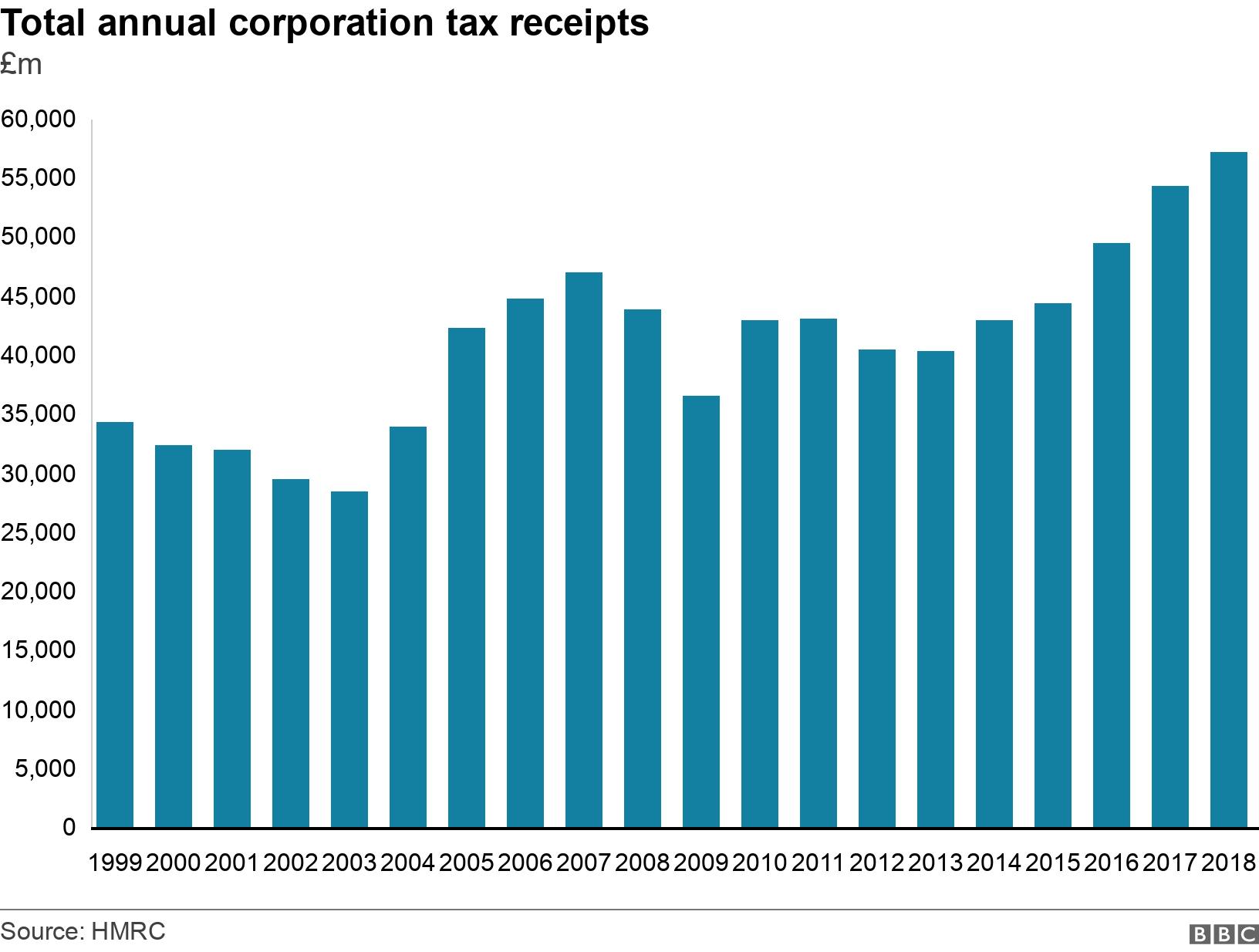

Does cutting corporation tax always raise more money? BBC News, The headline rate of corporation tax will increase to 25% for companies with over £250,000 in profits from 1 april 2025. For corporations, the 2025/2025 financial year marked the last year of corporation tax rates residing only at 19%.from april 2025, the rate of 25% was.

Corporate Tax Rates by Country Corporate Tax Trends Tax Foundation, The rate of diverted profits tax (dpt) will. Small profits rate at 19%.

Corporate tax isn’t working how can we fix it, globally? World, Apart from the substantial increase in the tax burden to most. The main rate of corporation tax (ct) will jump from 19% to 25% with effect from 1 april 2025.

The headline rate of corporation tax will increase to 25% for companies with over £250,000 in profits from 1 april 2025.